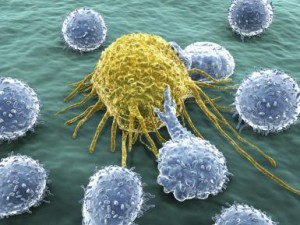

CAR-T therapies involve removing T cells from individual patients and engineering them to recognize and destroy that patient’s cancer. Early clinical results over the last few years raised considerable interest in this cell-based immunotherapeutic approach, and now that several hundred patients have been treated, the enthusiasm may be justified. New data presented this week at the American Society of Hematology (ASH) conference on Novartis CTL019 showed impressive results in several trials involving both adult and pediatric patients suffering from leukemia or lymphoma. Similar positive results were reported this week from trials conducted by Kite Pharma and Juno Therapeutics. Long-time biotech journalist Arlene Weintraub has written a good summary of the ASH excitement for Forbes. Unfortunately, mixed data from others (notably Bluebird Bio, whose mixed gene therapy results in sickle cell anemia and beta-thalessemia sorely disappointed investors) made already skittish investors punish the sector, causing the biotech indices to fall by 2 to 3 percent before recovering somewhat afterward.

As we have previously written, CAR-T therapies offer the chance of a durable response and so considerable hope, at least for these blood cancers. It will be interesting to see over time what gains may be further possible when such cell-based therapies are combined with checkpoint inhibitors and other approaches. Yet a number of questions and commercialization challenges still remain. Creating the cells by extracting them from patients, modifying them genetically, and then reinfusing those cells presents considerable manufacturing and logistical challenges for autologous approaches which no efficient model has yet been identified. We do not yet know whether the promising results to date in blood cancers will translate to solid tumors or earlier stage cancers. And with the cost front-loading profile of these therapies — and drug pricing issues at the forefront of discussion — will the market find the proposed cost of those therapies that make it to commercialization prohibitively high?